Difference Between QuickBooks Payroll and Gusto

Both QuickBooks Payroll and Gusto are popular subscription-based online payroll services that allow businesses to handle their payroll and file taxes. So, regardless of the size of your business, if you’re looking for a new payroll provider for your business, then QuickBooks and Payroll are the two obvious choices. Both of these are specifically made for businesses, particularly small businesses.

What is QuickBooks Payroll?

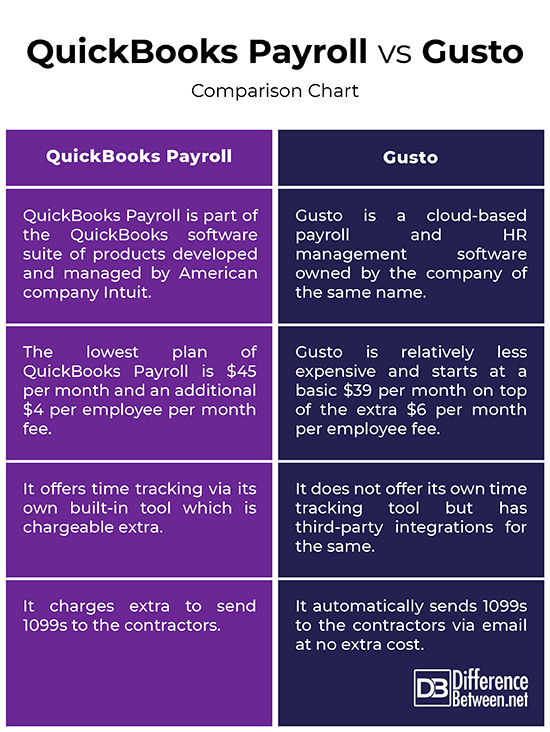

QuickBooks Payroll is one of the most popular online payroll service providers and part of the QuickBooks software suite of products that manage payroll functions and accounting processes for small to medium businesses. Developed and marketed by California-based Intuit, QuickBooks Payroll is subscription-based online payroll software that keeps businesses’ finances on track. It helps you perform basic financial tasks such as paychecks processing and printing, direct deposit payment, and filing and making payroll tax payment.

What is Gusto?

Gusto is yet another equally popular payroll and HR services provider owned and managed by the company of the same name. Gusto is a powerful people’s platform that helps small businesses takes care of their accounting, payroll and HR related services. Gusto does all the paperwork for you, whether it’s for hiring new employees or doing payroll or other employee management services, including HR. It seeks to simplify human resource practices for businesses across the United States. One of the brains behind Gusto is its CEO and co-founder Joshua Reeves.

Difference between QuickBooks Payroll and Gusto

Pricing

– The pricing of both QuickBooks Payroll and Gusto is divided into three different tiers. You have to pay a basic fee to use the software on top of per employee, per month fee. For both the services, you only have to pay this fee for currently active employees and for contractors you paid in the month. QuickBooks Payroll starts at $45 per month and an additional $4 per employee per month fee, while Gusto starts at a lowest $39 per month on top of the extra $6 per month per employee fee. Overall, both are affordable options for small business owners, but Gusto is relatively less expensive.

Features

– Features on both the platforms depend on the plan you choose but all plans for both come with some common features, including unlimited payroll processing, payroll availability in all 50 U.S. states, multiple pay rates, payroll tax calculations, automatic payroll and health benefits, etc. QuickBooks Payroll does run promotions on its service from time to time. Both the platforms do not differ much in terms of core features as well, providing easy ways to pay their employees without any hassle.

Employee Benefits

– While both the vendors provide workers compensation insurance as an add-on feature for a fee. For contractors, you need to provide them with a 1099 at the end of every year and Gusto automatically sends these to the contractors via email at no extra cost. QuickBooks Payroll, on the other hand, takes a fee for this service. QuickBooks, however, does offer time tracking via its own built-in tool which is chargeable extra. Gusto does not provide its own time tracking tool.

QuickBooks Payroll vs. Gusto: Comparison Chart

Summary

At the end of the day, which payroll is best is entirely up to you. If you rely heavily on freelancers and contractors on top of your regular full-time employees, you’re better off with Gusto because it automatically generates the 1099s for your contractors at no additional cost. While QuickBooks Payroll also provides direct deposit pay service for contractors, Gusto simply makes it easier to pay them without any hassle. QuickBooks is a great tool that makes other software tools play nicely together.

Is Gusto compatible with QuickBooks?

Gusto integrates with QuickBooks to provide specialized online accounting, including payroll automation, benefits management, HR management and payroll taxes.

Is Gusto a good payroll company?

Formerly known as ZenPayroll, Gusto is a popular cloud-based payroll and employee benefits solution provider that helps small businesses takes care of their accounting, payroll and HR related services, including payroll taxes and employee benefits management.

Is Gusto better than ADP?

Gusto’s features and usability make it an ideal payroll and HR management solution, especially for small businesses. ADP, on the other hand, offers industry leading payroll services to business of all sizes. Besides, both are leading payroll service providers.

What is the easiest payroll software to use?

QuickBooks Payroll is probably the easiest payroll software to set up and use and everything is automated, but if you’re looking for a complete package at an affordable pricing, Gusto might be a good option for you, especially if you are a small business.

Why is ADP better than Paychex?

ADP caters to businesses of all sizes and for those who are not so familiar with the payroll systems, ADP is probably the better option. Paychex has also established itself as a leading payroll and HR management service provider offering enterprise level solutions to both small and medium businesses.

Who prepares the payroll?

Payroll related functions are handled by the finance department or the human resources department in almost all organizations, including both non-profits and for-profit businesses. Payroll is a number driven service which requires skilled personals with knowledge of accounting and tax laws. So, payroll functions are better off with the finance department.

What is the cheapest way to do payroll?

One of the most reliable and cheapest ways to do payroll is to go for online payroll service providers like Gusto and QuickBooks Payroll.

Can I process my own payroll?

Payroll processing is a challenging task, even if you are a small business with a limited number of employees. You also need the knowledge of the tax laws and accounting, and financial background will help a lot. So, you can process payroll on your own if you are qualified and skilled enough to do it.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

1 Comment

Leave a Response

References :

[0]Nelson, Stephen L. QuickBooks 2020 All-in-One For Dummies. New Jersey, United States: John Wiley & Sons, 2020. Print

[1]Curtis, Veechi. Quickbooks For Dummies. New Jersey, United States: John Wiley & Sons, 2011. Print

[2]Rubini, Agustin. Fintech in a Flash: Financial Technology Made Easy. Berlin, Germany: Walter de Gruyter, 2018. Print

[3]Image credit: https://gusto.com/gusto-logo.png

[4]Image credit: https://cdn.merchantmaverick.com/wp-content/uploads/2018/05/qb-payroll.png

Great post. It was much needed. Love your simplistic style of explanation. 🙂