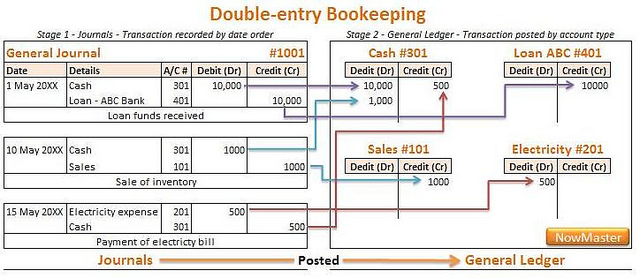

The beginner of accounting Luca Pacioli is the one who discovered the commonly used double entry system in book keeping. The double entry system of book-keeping is a system where, business transactions affect different sides of an account with either a debit or credit effect.

Debit indicates a destination while credit indicates a source of monetary benefit. In accounting, the transaction source is credited, and the destination account debited. Understanding both concepts can be taxing, but a necessity for any accounting practice.

What is a Debit?

Debits are expenses or any amount paid from one account into another, that results in an increase of assets and decrease in liabilities or equity on a balance sheet. Debiting is a formal accounting and bookkeeping practice that originated from the Latin term ‘debere’ meaning to owe. A debit is placed in the positive side of balance sheets and the negative side of the result items. In bookkeeping the debit is entered on the left side of double entry bookkeeping systems. The opposite side contains the credits.

In bookkeeping it is important to note the following:

- Debiting a debtor’s account means reducing debt

- Debiting an asset account means increasing assets

- Debiting an income account means income has decreased

- Debiting expense accounts implies the expenses have increased

Some of the accounts increased by debiting include assets (accounts receivables, inventory, equipment and cash), Expenses (rent, wages, interests), losses and drawing accounts. Some of the accounts decreased by debits include liabilities (payables), equity ( stock and retained earnings). Debit balances are the amount that remains after one series of entry has been done. In double bookkeeping the credit and debit accounts should be left equal.

What is a Credit?

Credits are outstanding amounts that are due to creditors by debtors. Within the accounting ledger, it is recorded on the right hand side of balance sheets. When one credits an account it means that there is a negative amount within that account. Increase in liabilities due to increased amounts in the payable results in the outcome being increased by a negative amount.

The double-entry principle also guides credits in that one effect on one account has to be reflected in another account. A creditor is that individual who offers credit. Credit has to be offered in exchange for products or services between creditors and debtors. The payment is based on the determined period.

It is important to understand the following in bookkeeping:

- Credits on a debtor account signifies increase in debt

- Credits on an asset account implies a reduction in assets

- Credits on an income account implies an increase in revenue

- Credits on the expense account imply the costs have reduced

The accounts increased by credits include liabilities (Payables), revenues( sales, earnings) and gains. The accounts that are decreased by credits include assets such as cash, receivables, supplies and finally land.

Differences Between Debit and Credit in Accounting

The main differences between these two accounting terms can be drawn from the following grounds:

-

Meaning of Debit and Credit in Accounting

Debits are amounts paid from one account and result in increase in assets. Credits are outstanding amounts due to creditors by debtors.

-

Location of Debit and Credit in Accounting

The debit is placed on the left side of the ledger accounts and the balance sheets. The Credit is placed on the opposite right side of ledger accounts and balance sheet.

-

Personal Accounts

In personal accounts receiver’s ledgers are debited while on the other side the givers are credited.

-

Use of Debit and Credit in Accounting

The credit is used to signify an amount that has been withdrawn. Debits are used to signify additions.

-

Nominal accounts

Expenses and losses in nominal accounts are debited while the incomes and gains in such accounts are credited.

-

Real Accounts

The debit signifies what comes in while the credit signifies what goes out.

-

Opposite resulting effect

Increase in credit decreases the debit and increase in debit decreases the credit.

Debit vs Credit in Accounting: Comparison Chart

Summary of Debit and Credit in Accounting

- Debits and credits are both important book keeping concepts invented by Luca Pacioli.

- Both the terms signify two hands of one body that is the ledger or the balance sheet.

- Every transaction affects both the credit and debit side.

- They both have an opposite resulting effect, increase in one leads to a decrease in the other. Increase in debits leads to an decrease in credits and vice versa.

- They should both be equal when tallied in the balance sheet.

- Difference Between S Corp and C Corp - September 9, 2018

- Difference Between Terrace and Balcony - September 9, 2018

- Difference Between Anabaptists and Evangelicals - August 31, 2018

it isgood

Reply