Difference Between Asymmetric Information and Adverse Selection

Risks are an integral part of investments. While the risks in some investments are considered close to zero, every investment involves some degree of risk. The process of identifying, analyzing and mitigating uncertainty in investment decisions, often referred to as risk management is vital in the financial world. This occurs when an investor or fund manager needs to estimate the likeability or amount of financial losses that could be incurred in a venture. Asymmetrical information and adverse selection are two factors that can affect the outcome of investment options.

Asymmetric Information

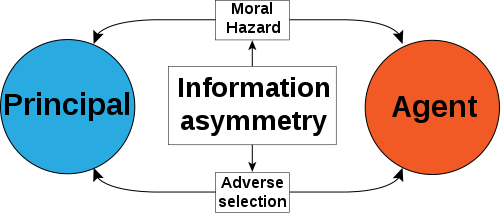

Also referred to as information failure, this is a situation where one party enters an economic transaction while processing more knowledge compared to the other party. In most instances, this occurs when a person selling goods has more product information than the person buying the products.

Asymmetric information applies to any economic trade. For instance, teachers, attorneys, accountants, engineers, nutritionists, doctors, drivers and fitness instructors have more knowledge than the other parties.

Asymmetric information forms part of a healthy market economy since workers become more productive in their respective fields and provide more value to other parties involved. An alternative to asymmetric information, however, is for workers to study all fields. This is, however, impractical. A practical alternative would be to avail information through inexpensive means such as the internet.

Asymmetric information may sometimes be associated with fraudulent consequences. For instance, an insurance company may encounter a scenario where a person conceals information at the onset of a health insurance policy. If the person falls ill due to the non-disclosed problem, then the insurance company may raise premiums for the customers, forcing some to withdraw from the policies.

Adverse Selection

This is a case where sellers withhold vital information about a product or service to the buyers. In this case, asymmetric information is exploited.

Adverse selection is common in the insurance sector where those in high-risk lifestyles purchase life insurance products. This often leads to doing riskier and less profitable business. To avoid adverse selection in the insurance sector, insurance companies identify groups of people who are more risk-averse and charges them more money for the services. This involves the evaluation of peoples’ current health, weight, family history, height, driving record, lifestyle risks and medical history, just to name a few.

The adverse selection also occurs in the marketplace. For instance, a seller may have better information about a product or service and use this to his/her advantage which ends up short charging the buyers. For example, a seller may convince a consumer to buy a second-hand car knowing of the vehicle’s defects.

Similarities between Asymmetric information and Adverse selection

- Both entail product or service knowledge that could affect economic transactions

Differences between Asymmetric information and Adverse selection

Definition

Asymmetric information refers to a situation where one party enters an economic transaction while processing more knowledge compared to the other party. On the other hand, adverse selection refers to a case where sellers withhold vital information about a product or service to the buyers.

Knowledge among parties

In asymmetric information, both parties are knowledgeable about a product or service. However, in adverse selection, the seller is more knowledgeable about a product or service.

Asymmetric information vs. Adverse selection: Comparison Table

Summary of Asymmetric information vs. Adverse selection

Asymmetric information refers to a situation where one party enters an economic transaction while processing more knowledge compared to the other party. On the other hand, adverse selection refers to a case where sellers withhold vital information about a product or service to the buyers. While both parties in asymmetric information are knowledgeable about a product or service, the seller is more knowledgeable about a product or service.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Bebczuk Nestor & Bebczuk R. Asymmetric Information in Financial Markets: Introduction and Applications. Cambridge University Press, 2003.https://books.google.co.ke/books?id=dEPt1Rz4z6EC&pg=PA7-IA10&dq=Difference+between+asymmetric+information+and+adverse+selection&hl=en&sa=X&ved=2ahUKEwjP84fWgMDtAhXtA2MBHUPPBIkQ6AEwAHoECAEQAg#v=onepage&q=Difference%20between%20asymmetric%20information%20and%20adverse%20selection&f=false

[1]O’Brien A & Hubbard R. Microeconomics. Pearson Australia, 2014. https://books.google.co.ke/books?id=L8aaBQAAQBAJ&pg=PA442&dq=Difference+between+asymmetric+information+and+adverse+selection&hl=en&sa=X&ved=2ahUKEwjP84fWgMDtAhXtA2MBHUPPBIkQ6AEwAXoECAQQAg#v=onepage&q=Difference%20between%20asymmetric%20information%20and%20adverse%20selection&f=false

[2]Sheehan P & Hansanti S. International Finance in Emerging Markets: Issues, Welfare Economics Analyses and Policy Implications. Springer Science & Business Media, 2008. https://books.google.co.ke/books?id=DN5pGov7CLkC&pg=PA44&dq=Difference+between+asymmetric+information+and+adverse+selection&hl=en&sa=X&ved=2ahUKEwjP84fWgMDtAhXtA2MBHUPPBIkQ6AEwBHoECAUQAg#v=onepage&q=Difference%20between%20asymmetric%20information%20and%20adverse%20selection&f=false

[3]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/b/b9/Principal%E2%80%93agent_problem_variantion_2.svg/500px-Principal%E2%80%93agent_problem_variantion_2.svg.png

[4]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/3/36/Imperfect_competition_after_regulation.svg/500px-Imperfect_competition_after_regulation.svg.png