Difference Between ADP Payroll and QuickBooks Payroll

Accounting and finance platforms are some of the most vital sections in any business. The convenience and simplification of tasks is something that most enterprises look forward to. With the availability of a wide variety of platforms, businesses no longer have to rely on manual processes. However, choosing accounting software is not a walk in the park. You have to consider different factors such as the functionality, cost, efficiency and suitability of your business. ADP and QuickBooks are among the most renowned payroll software providers. But what are the differences between the payroll services offered by the two providers?

What is ADP Payroll?

ADP payroll is perfect for businesses that have complex regulatory and employee situations. This means that it’s a great option for businesses that are growing as well as those with a great growth potential since it’s easier to scale. It is also more beneficial for international enterprises. And with the employee portal and mobile app, businesses can keep track of workers who are on the move.

What is QuickBooks Payroll?

QuickBooks payroll is ideal for businesses that undertake pay runs frequently, have different pay runs as per employee categories or have a sporadic payroll processing method. Such enterprises will find QuickBooks more cost-effective. Another benefit of QuickBooks payroll is that a business will not be charged extra for more payroll runs. However, it is great for enterprises with established payroll structures.

Similarities between ADP payroll and QuickBooks payroll

- Both have efficient payroll services based on different business models

Differences between ADP payroll and QuickBooks payroll

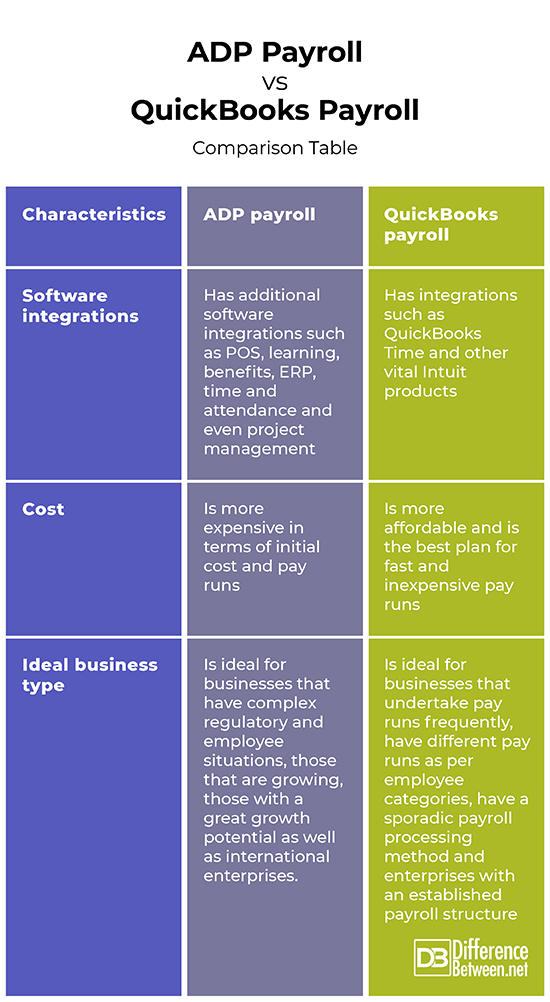

Software integrations

ADP payroll has additional software integrations such as POS, learning, benefits, ERP, time & attendance and even project management. On the other hand, QuickBooks payroll has integrations such as QuickBooks Time and other vital Intuit products.

Cost

ADP is more expensive in terms of initial cost and pay runs. On the other hand, QuickBooks payroll is more affordable and is the best plan for fast and inexpensive pay runs.

Ideal business type

ADP payroll is ideal for businesses that have complex regulatory and employee situations, those that are growing, those with a great growth potential as well as international enterprises. On the other hand, QuickBooks payroll is ideal for businesses that undertake pay runs frequently, have different pay runs as per employee categories, have a sporadic payroll processing method and enterprises with an established payroll structure.

ADP payroll vs. QuickBooks payroll: Comparison Table

Summary of ADP payroll vs. QuickBooks payroll

ADP payroll is ideal for businesses that have complex regulatory and employee situations, those that are growing as well as those with a great growth potential since it’s easier to scale and international enterprises. On the other hand, QuickBooks payroll is ideal for businesses that undertake pay runs frequently, have different pay runs as per employee categories, have a sporadic payroll processing method and enterprises with established payroll structure. While these two payroll providers vary, the choice should be based on the structure of a business.

Is QuickBooks Payroll better than ADP?

While the choice of a payroll system should be based on the structure of a business, ADP payroll is more expensive but offers more benefits. QuickBooks, on the other hand, is less expensive but has fewer extra integrations.

Is ADP compatible with QuickBooks?

Yes. ADP is compatible with QuickBooks. Online users can run ADP within QuickBooks.

What is the difference between QuickBooks Basic Payroll and Enhanced Payroll?

The difference between the two is in functionality. While QuickBooks basic has minimal payroll taxes and calculation functions, Enhanced payroll has a complete set of payroll preparation and filing functions.

What does QuickBooks charge for payroll?

QuickBooks has three payroll online plans between the range of $45- $125 for every employee per month and an additional $4- $10 per month per employee. For the desktop version, businesses remit $29- $109 and $2 for every month per month.

Can I use QuickBooks payroll without subscription?

Yes, you can. However, you will do the calculation, enter payroll data and file tax forms without automated processes.

Is QuickBooks good for payroll?

Yes, QuickBooks is good for payroll. It all depends on the structure of your business.

Does QuickBooks help with payroll?

Yes. It saves time and eases the payroll processes.

How many meals can I write off?

You can write off 50% of the meals you buy.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Bonnie Biafore. QuickBooks 2014: The Missing Manual: The Official Intuit Guide to QuickBooks 2014. "O'Reilly Media, Inc.", 2013. https://books.google.co.ke/books?id=PQJ1AQAAQBAJ&printsec=frontcover&dq=quickbooks&hl=en&sa=X&ved=2ahUKEwi7lbuNtMLxAhUCixoKHYQkBlEQ6AEwAHoECAcQAg#v=onepage&q=quickbooks&f=false

[1]Elaine Marmel. QuickBooks Online For Dummies. John Wiley & Sons, 2015. https://books.google.co.ke/books?id=_OobBgAAQBAJ&printsec=frontcover&dq=quickbooks&hl=en&sa=X&redir_esc=y#v=onepage&q=quickbooks&f=false

[2]Stephen L. Nelson. QuickBooks 2020 All-in-One For Dummies. John Wiley & Sons, 2020. https://books.google.co.ke/books?id=zXXADwAAQBAJ&printsec=frontcover&dq=quickbooks&hl=en&sa=X&ved=2ahUKEwi7lbuNtMLxAhUCixoKHYQkBlEQ6AEwCXoECAQQAg#v=onepage&q=quickbooks&f=false

[3]Image credit: https://commons.wikimedia.org/wiki/File:Intuit_QuickBooks_logo.png

[4]Image credit: https://commons.wikimedia.org/wiki/File:ADP_Red_Logo_w_Tag_RGB_Center_updated.png