Difference Between Tax and Audit

Brainstorming about whether to pursue a career in tax or audit? This is probably a million dollar question every accounting student or anyone seeking a position in public accounting asks themselves. For some, it’s quite simple because they know what they’re doing, while this question gives many people unease. We help you break down what each career path entails.

What is Tax?

Taxation refers to the set of taxes that taxpayers pay towards government funding and expenditures, and public works. In a larger sense, it pertains to the whole fiscal policy of governments. It is a means by which a government imposes tax on its citizens and business entities. It is a common practice of collecting a fraction of your taxable income and using it for public services. In fact, taxes are the most important source of government revenue.

What is an Audit?

Auditing involves examination and evaluation of books, accounts and vouchers of the business, and it is carried out to report on the financial statements to check if they are drawn properly and indicate fair business practices. Auditing is getting your hands dirty by selecting samples of business process records to check and acknowledge what your clients have on their income statements and balance sheets. Audit refers to a financial statement audit, an official evaluation of a company’s accounts typically by an independent third party.

Difference between Tax and Audit

Scope

– Auditing involves investigating information prepared by someone else to decide whether the information is fairly documented. In audit, you verify the whole financial statements are reasonable. In tax, you take those financial statements and take the parts that are relevant for tax purposes and make adjustments accordingly. Audit focuses on investigating all the aspects of an entity relevant to financial statements. It evaluates whether the evidence makes sense and based on the evaluation, you acknowledge the correctness of the financial statements.

Busy Season

– One of the reasons to choose tax over audit is that its hours are more predictable and it’s less busy than audit busy season, but not necessarily. The tax busy season can get pretty busy as well, but audit season could get pretty intense in that they find themselves working days and nights on weekends as well, and this could go on for weeks or even months. But, in general, it mostly depends on the size of the clients.

Flexibility

– Tax is relatively less flexible than audit. Tax is all about pre-defined laws and the tax people tend to be more precise. Tax is a mandatory financial fee levied by the government on its citizens for public works and government spending. Audit, on the other hand, is more flexible because it depends on multiple factors, such as nature of the business, the complexity of the transactions, the volume of transactions, business environment, and so on.

Client Relationship

– One of the key differences between tax and audit is relationship with your client. Firms may provide the same professional services to many clients, but the relationship with client differs in both. On the tax side, you must know your clients well because your objective is aligned. So, you and your clients are on the same team. On the audit side, you may have a conflicting opinion with your clients and at times, you may have to face some skepticism.

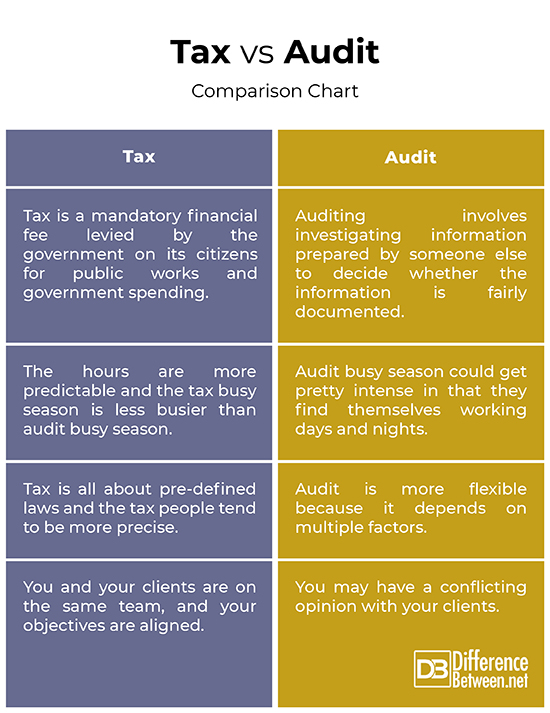

Tax vs. Audit: Comparison Chart

Summary

Taxation is more specialized and the hours are more predictable, while auditing could get more intense in terms of the work hours and needing to get things done on time. Also, the sheer volume of work that goes into auditing a public company and the vast number of transactions that would occur could become stressful. On the tax side, the pressure usually lies in tax return deadlines and the internal deadlines set by the company or firm. However, the deadlines are pretty much manageable because the scope of the work is not enormous like auditing.

Does tax or audit pay better?

Tax tends to be more specialized, so it pays a bit better than auditing.

What is audit and taxation?

Taxation is the mandatory financial charges levied by the government on individuals or entities and taxes are applicable almost everywhere, every country in the world. Taxes are imposed primarily to fund public expenditures and government spending. Auditing is an objective independent evaluation of the financial statements of any entity, whether profit making or not-for-profit.

Is tax or audit more competitive?

Auditing starts with knowing your clients and the types of services it requires. An independent third party examines and evaluates the financial statements of an entity. So, auditing tends to be more competitive.

Is audit the worst job?

Sometimes, auditing gets a bit intense, even on the busy season in that auditors find themselves working extended hours, and on weekends too, which could go on for weeks or months. So, auditing does get boring at times. But, that doesn’t make it the worst job either.

Is auditing a stressful job?

Yes, auditing can be very stressful, particularly during the busy season when auditors have to sit through days and nights and on weekends, and this could go on for weeks or even months.

Do auditors make good money?

High level external accountants and auditors are paid really well.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image credit: https://commons.wikimedia.org/wiki/File:Audit.jpg

[1]Image credit: https://live.staticflickr.com/6056/6355404323_cf97f9c58e_b.jpg

[2]Loughran, Maire. Auditing For Dummies. New Jersey, United States: John Wiley & Sons, 2010. Print

[3]Salanié, Bernard. The Economics of Taxation. Massachusetts, United States: MIT Press, 2011. Print

[4]McGee, Robert W. The Philosophy of Taxation and Public Finance. Berlin, Germany: Springer Science & Business Media, 2003. Print