Difference Between Profit Center and Investment Center

Profitability is the backbone of any business. However, not every section of the company is involved in the direct generation of revenues. Some are classified as costs but support the functioning of the company. Others are involved in assets while others are not. Companies that have learned the secret have separated their businesses into segments to maximize these segments’ strengths. For example, companies have profit centers, cost centers, and investment centers which could all be in the same location but operating separately. In this article, let’s find out the differences between profit centers and investment centers.

Profit Center

A Profit Center refers to a branch of a company that directly contributes to the entire organization’s earnings. It is generally treated as a separate entity responsible for generating its income. The profits and losses from this center are calculated independently from other areas of the company. The term profit center was introduced in 1945 by Peter Drucker.

Profit centers are important to ascertain which areas of a business are more or less profitable than others. For cross-comparison and more accurate analysis, they differentiate between certain revenue-generating activities. The analysis helps in determining the future allocation of available resources. It also helps determine if some activities should be cut completely.

The profit center manager is help responsible for both revenue and costs, and hence profit. The manager is held accountable to drive sales income-generating activities leading to cash inflows as he manages the cost-generating tasks. Profit center management is thus more challenging than managing a cost center. The managers in profit centers have authority to make decisions regarding product prices and operating costs. They also experience a lot of pressure to ensure that their division gives profit year by year, meaning the sales must outweigh the costs. This can be done either by increasing revenue, decreasing expenses, or both.

Examples of profit centers include a store or a sales organization whose profitability is measurable.

Investment Center

An investment center is a business unit that uses capital to contribute to the profitability of a company. The performance of an investment center is evaluated by the revenues it brings in through investments in assets in comparison to the overall expenses. It is sometimes referred to as an investment division.

It’s a center that is responsible for its revenue, expenses, and assets while managing its financial statements. The financial statements are ideally a balance sheet and an income statement.

The investment center prioritizes offering returns on assets invested mainly in the investment center.

The center might also invest in activities and assets that are not necessarily related to the company’s operation. This could include investments in other companies which diversifies the company’s risk.

An investment center most likely is a subsidiary company or division because costs, revenues, and assets have to be identified separately. It can usually be termed as an extension of the profit center where income and costs are measured. The difference is that it’s only in an investment center that assets employed are also measured and compared to the profits made.

An example of an investment center is the financing arm of an automobile maker or department store.

Investment centers are beneficial to companies as financialization causes companies to seek profits from investments and lending to add to the overall production.

The manager of an investment center is in control over the investments this center has to bring profits to the department.

Similarities between Profit Center and Investment Center

- Both the profit and investment centers are centers that are measured separately from other departments in a company in terms of revenues and expenses.

- Both the profit center and the investment center ensure the profitability of a company.

Differences between Profit Center and Investment Center

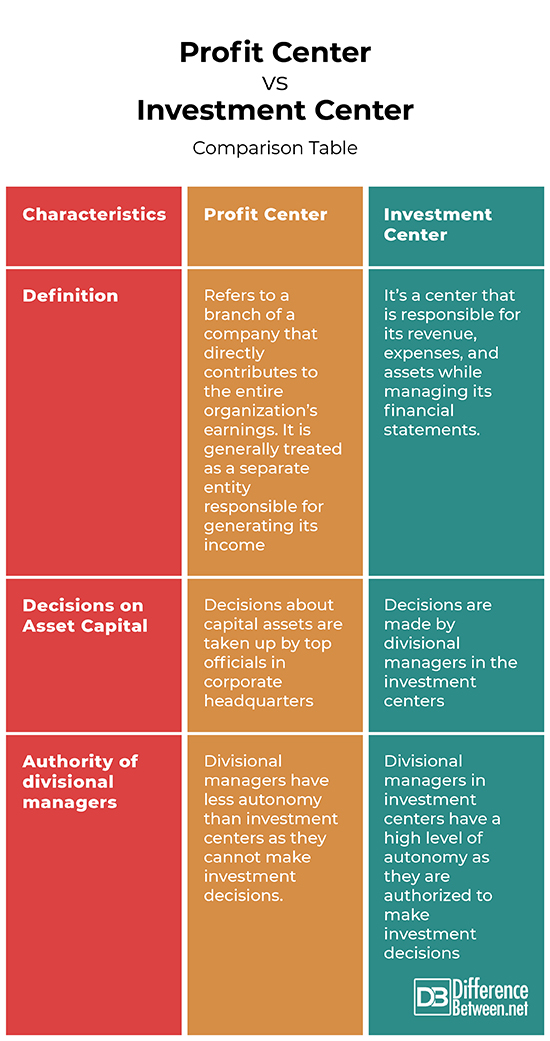

Definition

A Profit Center refers to a branch of a company that directly contributes to the entire organization’s earnings. It is generally treated as a separate entity responsible for generating its income. On the other hand, an investment center is a business unit that uses capital to directly contribute to the profitability of a company. It is responsible for its revenue, expenses, and assets while managing its financial statements.

Decisions on Asset Capital

Decisions about capital assets in profit centers are taken up by top officials in corporate headquarters while in investment centers the decisions are made by divisional managers in the investment centers.

Authority of divisional managers

The divisional managers in profit centers have less autonomy than in investment centers as they cannot make investment decisions. Divisional managers in investment centers have a high level of autonomy as they are authorized to make investment decisions.

Profit Center vs. Investment Center: Comparison Table

Profit Center vs. Investment Center: Conclusion

A profit center refers to a branch of a company that directly contributes to the entire organization’s earnings. It is generally treated as a separate entity responsible for generating its income. Investment Center refers to a center that is responsible for its revenue, expenses, and assets while managing its financial statements. Now you know.

FAQS:

What is a cost-profit and investment center?

It’s a center that has the three centers combined. It has a segment that is responsible for the generation of revenues (profit), another that does not generate its income but supports the center (cost), and another that deals with assets and is responsible for its costs and profits while managing its financial statements.

What is meant by investment center?

It’s a center that is responsible for its revenue, expenses, and assets while managing its financial statements.

What are profit centers?

A Profit Center refers to a branch of a company that directly contributes to the entire organization’s earnings.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Platt D & Hilton R. Managerial Accounting - Global Edition. UK Higher Education Business Accounting. McGraw Hill, 2014. https://books.google.co.ke/books?id=JssvEAAAQBAJ&pg=PA501&dq=Difference+between+Profit+Center+and+Investment+Center&hl=en&sa=X&ved=2ahUKEwjV3-H8nOn3AhXvRvEDHbCzBXwQ6AF6BAgEEAI#v=onepage&q=Difference%20between%20Profit%20Center%20and%20Investment%20Center&f=false

[1]Siegel J & Shim J. Budgeting Basics and Beyond. John Wiley & Sons, 2008. https://books.google.co.ke/books?id=FR6WAAAAQBAJ&printsec=frontcover&dq=Difference+between+Profit+Center+and+Investment+Center&hl=en&sa=X&ved=2ahUKEwjV3-H8nOn3AhXvRvEDHbCzBXwQ6AF6BAgFEAI#v=onepage&q=Difference%20between%20Profit%20Center%20and%20Investment%20Center&f=false.

[2]Murugan M & Srinivasan NP. Accounting for Management. S. Chand Publishing, 2006. https://books.google.co.ke/books?id=KAsbEAAAQBAJ&pg=PA648&dq=Difference+between+Profit+Center+and+Investment+Center&hl=en&sa=X&ved=2ahUKEwjV3-H8nOn3AhXvRvEDHbCzBXwQ6AF6BAgIEAI#v=onepage&q=Difference%20between%20Profit%20Center%20and%20Investment%20Center&f=false